Self-employed Mortgage with one-month bank statement

For self-employed borrowers 2019 is the year of mortgage opportunity. Business owners have the chance to apply for purchase and refinance mortgages using their most recent bank statements instead of tax returns. It is not a stated income loan, it’s as close you’re going to get.

Our one month banks statement self employed mortgage program requires providing the most recent 1 month of bank statements. Which is far less than the two month banks statement program. This is a huge advantage for borrowers that are looking for a mortgage that does not need tax returns and is as a close as it gets to the stated income loans we witnessed about 10 years ago.

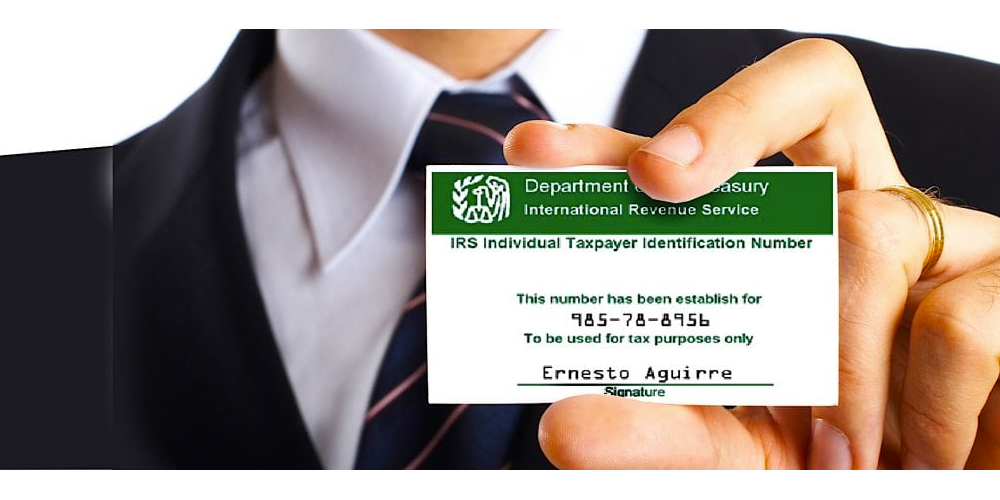

There are additional requirements such as confirming a two-year history of self-employment. This is in the form of a CPA letter or a business license.

This mortgage was introduced in the third quarter of 2018 and has been a huge hit amongst our clientele. We’ve recently closed over a dozen purchase and refinance mortgage transactions in downtown Los Angeles, Glendale, Burbank, Beverly Hills, Santa Monica, Sherman Oaks, West Hollywood and the surrounding cities in the greater Los Angeles area. We are able to offer this option to self-employed borrowers in the entire state of California.

First time home buyers mortgages friendly

The best part about this option is that it is also available for first time home buyers as well. So long as you can talk to you in 24 months of rent history. Additional down payment requirements are applied.

This self-employed mortgage ALLOWS GIFT FUNDS

A major part of first-time home buyer programs is the auction to gift the down payment. And yes, gift funds are allowed in this case.

Information subject to change without notice. This is not an offer for extension of credit or a commitment to lend. All rates, fees, and programs are subject to change and/or withdrawal from the lending practices without notice. Eligibility can vary based on meeting minimum credit score/tradeline, documentation, Loan to Value, and occupancy.